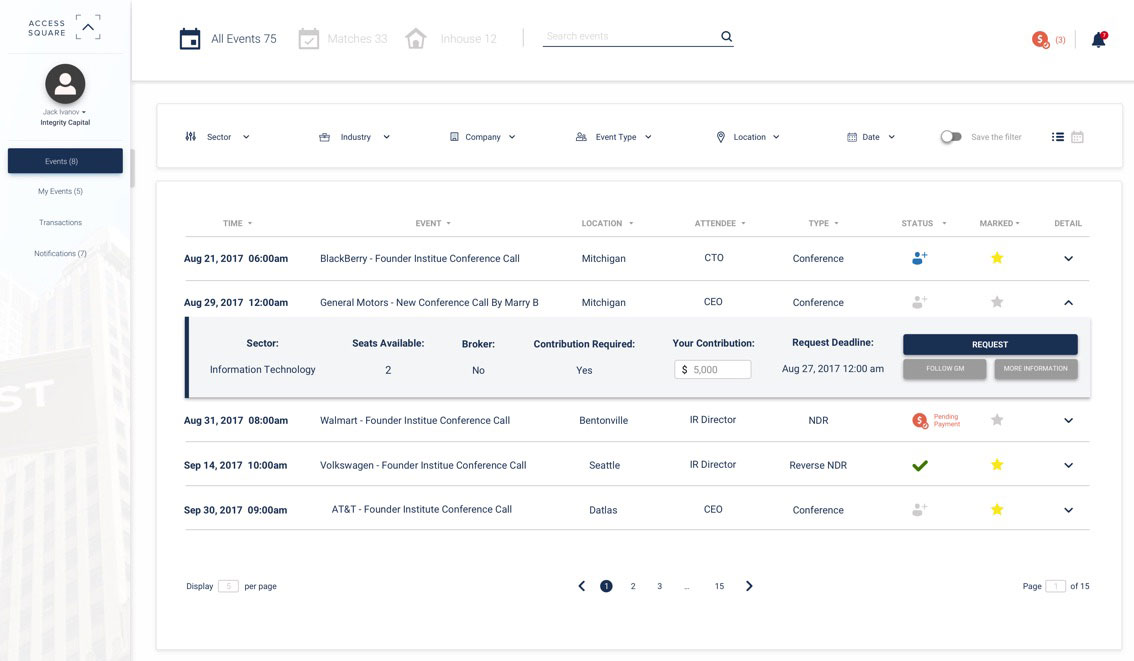

Inventory of events

One inventory of upcoming management meetings

In-house notifications

Notifications for all in-house hosted meetings

Confidential inquiry

Secure and confidential approach to express interest

Sector-specific conferences

Investor-organized sector specific conferences

Optimized target list

Leverage of third-party shareholder target lists

Blind auction

Confidential view of inbound requests and interests

Expense reimbursement

Expense free investor meetings

Complete control

Absolute control of attendees list

Access Square is a technology-enabled corporate access platform that improves accessibility to the senior management of U.S. public companies by qualified investors. We partner with forward-looking corporates and compliance-conscious investors to improve value proposition in corporate access.

We stand out from traditional providers because we offer increased transparency and flexibility while resolving potential conflicts of interest embedded within a broker-dealer model.

Access Square aims to level the playing field in corporate access and subscribes to "pay to play" philosophy. We strive to create value for all parties involved in the process.

Our focus is primarily on providing corporate access to public companies within Fortune 500, though we broadly seek opportunities to partner with corporates where value-add is clearly visible.

1. Unbundling of sell-side research services from trading commissions

2. Hard dollar budgets allocated towards investment services

3. Separated accounts for corporate access

1. Struggle to outperform low cost index and systematic offerings

2. Increased concentration of AUM with largest funds

3. Business development teams better manage resources

1. Challenge to remain relevant with increased data availability and transparency

2. Shrinking wallets as clients struggle and margins compress

3. Pressure to secure corporate access exposes conflict of interest

You will receive a notification as soon as a new event opportunity arises. For every new opportunity, you receive access to full information. Our team is always available to answer questions.

Once you're selected for the event, a member of our team will reach out to confirm your booking as soon as the purchase is complete. Access Square can work with your assistant to keep you focused on making informed investment decisions.

Should you choose to, we ask for feedback on the event. We encourage you to participate by providing a discount for future interactions.

Our online platform offers a transparent, secure and efficient way to review and book events.

You can express interest in any event directly on our site. Alternatively, you can opt in to receive a guaranteed booking through a previously preselected target criteria.

Access Square will provide information and timely support to make sure the interaction goes smoothly.

Thanks for reaching out to us. We will be in touch with you shortly.

info@access-square.com

+1(212) 804 8323

43 W 23rd Street

New York, NY